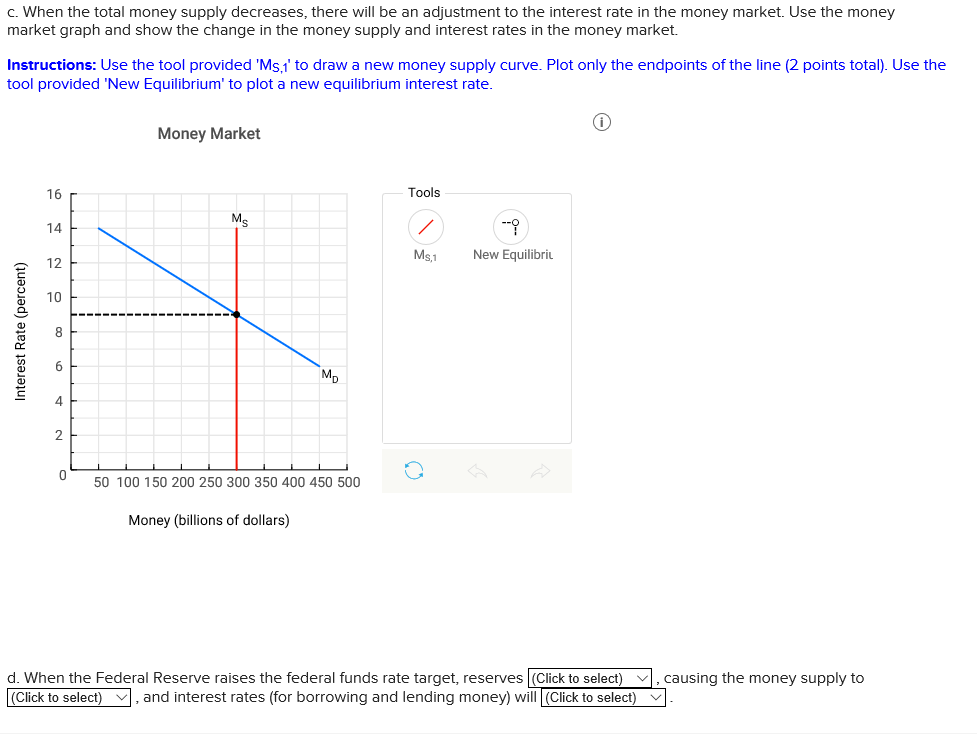

The Fed Can Decrease the Federal Funds Rate by

1 That quarter-point drop in interest rates may seem small but it can have a big impact on your finances. Decreasing the money supply.

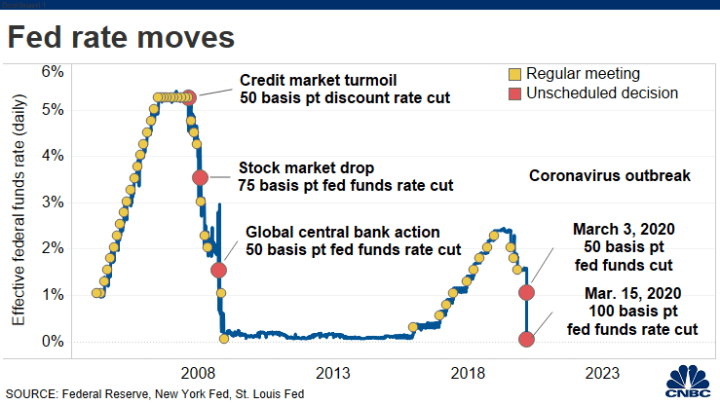

Why The Fed Lowered Interest Rates Again The New York Times

This is the first time that the Fed has lowered the federal funds rate since the Great Recession.

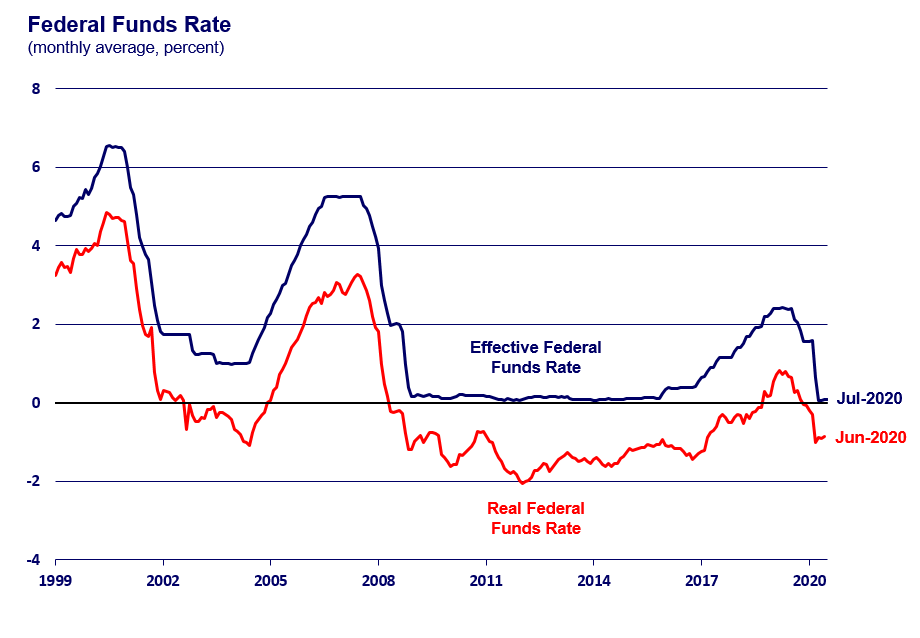

. As we can see the fed funds rate and the one-year Treasury rate track each other very closely. It can decrease the supply of federal funds by selling assets and destroying the federal funds it receives. In such times if additional support is desired the Fed can use other tools to influence.

Federal funds are the reserves kept by banks at one of the 12 regional Federal Reserve Banks. Banks set their own interest rates when borrowing from other. The Fed can reduce the federal funds rate by a.

Higher money supply leads to higher inflation pushing down the federal funds rate. If the Fed wants the federal funds rate to decrease then it buys government securities from a group of banks. The Fed does the opposite when it wants rates to be higher.

To decrease the money supply it could buy bonds. It sets the range higher forcing banks to raise their overnight lending rates. The Fed can reduce the federal funds rate by decreasing the money supply.

Abuy government bonds from the public. The Fed raised rates last month for the first time in three years and released projections showing most policymakers thought the policy rate would end the year at least in the range of 175-2. 26 2022 meeting the Federal Open Market Committee FOMC said it would maintain the target fed funds rate at a range of 0 to 025.

To reduce the federal funds rate the fed caninteractive learning posterinteractive learning poster. And the stronger demand for goods and services may push wages and other costs higher influencing inflation. This forces the banks to lower their overnight lending rates so they can lend funds to each other.

2 In contrast the interest rate on a 10-year Treasury bond does not appear to move as closely with the fed. The Fed can reduce the federal funds rate by Select one. Increasing the money supply.

Fed Funds Rate Current target rate 025-050 050. The large supply of reserves means that there are many potential lenders and few borrowers pushing the federal funds rate--the rate at which banks and certain other institutions borrow and lend with each other--down close to the IOER rate the floor below which banks are better off depositing with the Fed than lending. A low federal funds rate can also be achieved if the Fed sets a lower discount rate.

Businesses can also hire more workers influencing employment. Up to 20 cash back To reduce the Federal funds rate the Fed can A buy government To reduce the Federal funds. Sell government bonds to commercial banks.

To increase the money supply it could sell bonds. To increase the money supply it could sell bonds. The Fed sets a target for the fed funds rate year-round.

To decrease the money supply it could buy bonds. During economic downturns the Fed may lower the federal funds rate to its lower bound near zero. To reduce the Federal funds rate the Fed can.

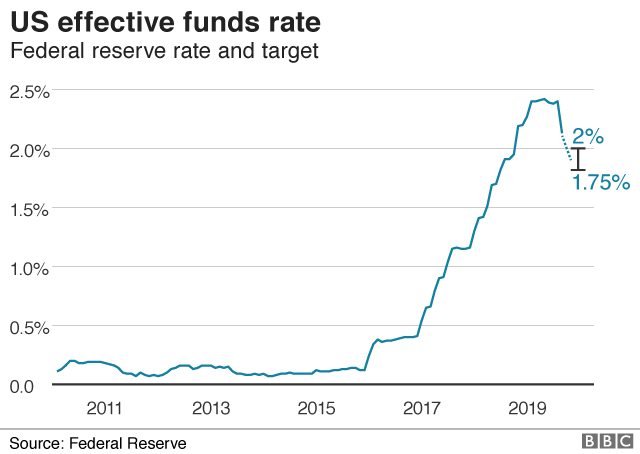

To increase the money supply it could sell bonds. To increase the money supply it could sell bonds. On Wednesday the Federal Reserve announced that they would be lowering the federal funds rate from 225 to 20.

A buy government bonds from the public B increase the discount rate C increase the prime interest rate D sell government bonds to commercial banks. Increasing the money supply. Then cognizant that its actions affect economic activity with a lag it must decide whether to alter the federal funds rate.

The Fed can reduce the federal funds rate by a. Decreasing the money supply. The FOMC sets the target rate range lower if it wants the rate to be lower.

Decreasing the money supply. Bincrease the discount rate. The Fed can increase the supply of federal funds by purchasing assets with newly created balances.

To decrease the money supply it. To decrease the money supply it could buy bonds. The interest rate at which banks and other depository institutions lend money to.

To decrease the money supply it could sell bonds. To reduce the Federal funds rate the Fed can. Decreasing the money supply.

Increasing the money supply. Although it is still debatable whether the Fed leads or follows the market movements in the policy rate are associated with similar movements in short-term interest rates. Lowering the target for the Federal Funds Rate pour money into the banking system because to increase the money supply the FED buys bonds on the open market which increases the.

The Fed has the ability to influence the federal funds rate by changing the amount of reserves available in the funds market through open-market operationsnamely the buying or selling of government securities from the banks. Increasing the money supply. Buying and selling assets in this manner is referred to as open-market operations.

To increase the money supply it could buy bonds. A 025-point decrease in the fed funds rate tends to increase stock prices because investors know that lowering interest rates will stimulate the economy. A decrease in the federal funds interest rate stimulates economic growth but an excessively high level of economic activity can cause inflation pressures to build to a point that ultimately undermines the sustainability of an economic expansion.

The Fed can reduce the federal funds rate byadecreasing the money supply. The Federal Funds Rate. To decrease the money supply it could buy bonds.

To decrease Federal Funds Rate The FED must increase the money supply. On the other hand a 025-point increase in the rate can send stock prices down as investors anticipate slow growth. To decrease the money supply it could sell bonds.

The Fed can reduce the federal funds rate by To decrease the money supply it could sell bonds. See the answer See the answer done loading. Hence the Fed can change the federal funds.

Cincrease the prime interest rate. Decreasing the money supply.

Effective Federal Funds Rate Fred Fedfunds Historical Data And Chart Tradingview

What A Federal Reserve Rate Increase Means For You The New York Times

Federal Reserve Policy And Interest Rates In 10 Charts The Real Economy Blog

Fed Raises Rates And Projects Six More Increases In 2022 The New York Times

Solved Suppose The Reserve Requirement Is 20 And That The Chegg Com

Discount Rate Prime Rate And The Federal Funds Rate What It All Means To You And Your Wallet

/dotdash_INV_final_The_Federal_Funds_Prime_and_LIBOR_Rates_Jan_2021-01-8010722eb0f94ecd9cbabd669c64e4e8.jpg)

The Federal Funds Prime And Libor Rates Definition

Federal Reserve Cuts Rates To Zero And Launches Massive 700 Billion Quantitative Easing Program

What Is The Federal Funds Rate The Motley Fool

Us Fed Cuts Interest Rates For Second Time Since 2008 Bbc News

The Federal Funds Rate Federal Reserve Bank Of Chicago

:max_bytes(150000):strip_icc()/fredgraph-6da2f6d034614be89a641e5e5df9ee4d.jpg)

How The Fed Funds Rate Hikes Affect The Us Dollar

The Surprising Thing That Happens To Stock Markets When The Fed Cuts Interest Rates By Nick Maggiulli Marker

Federal Reserve Approves First Interest Rate Hike In More Than Three Years Sees Six More Ahead

/united-states-federal-reserve-building--washington-dc--usa-699686820-4b7edca940c24b7faadbd6265c702212.jpg)

What Does A Low Federal Funds Rate Mean

The Fed Monetary Policy Monetary Policy Report

Alborsanews Federal Reserve Monetary Policy Bond Market

Why The Fed Lowered Interest Rates Again The New York Times

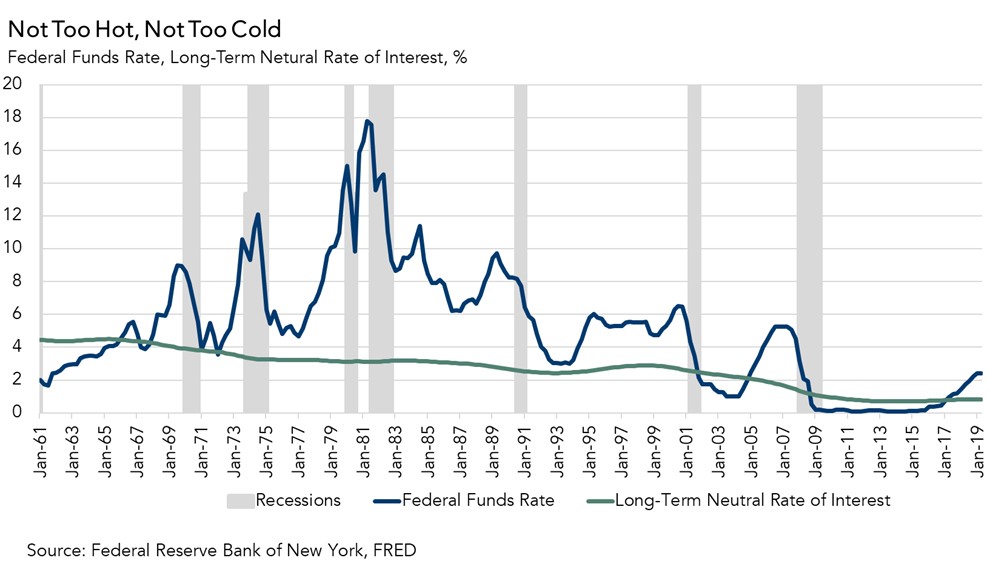

What Is The Neutral Rate Of Interest And How Does It Influence The Federal Reserve

Comments

Post a Comment